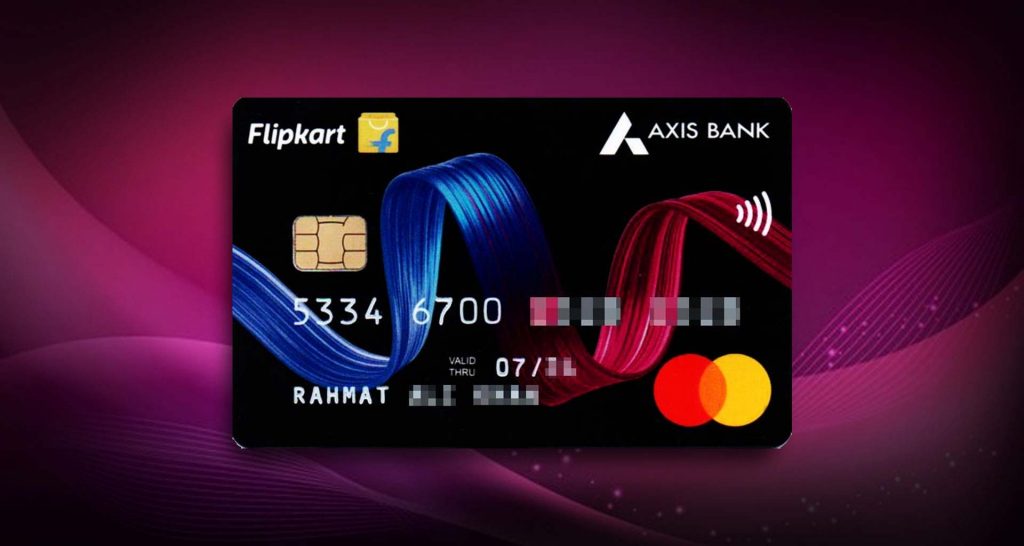

Filpkart and Axis Bank have come together to offer a co-branded credit card i.e. Flipkart Axis Bank Credit Card to its users so that they can enjoy exciting benefits, including extra reward points, discounts, and complimentary insurance cover. This credit card is worth considering if you’re looking for a way to get more value from your online shopping. As in this post, you may get to know various interesting things about this Flipkart Axis Bank Credit Card such as the applying process, closure process, features and many more.

What is a Flipkart axis bank credit card?

The Flipkart Axis Bank Credit Card is issued by Axis Bank because the Axis bank has a partnership with the Flipkart which is a famous online marketplace. Moreover, this card offers lots of exclusive benefits and rewards to its users on purchases made on Flipkart and other Axis Bank products and services. Furthermore, this card can be used on various other things such as travel, dining, shopping from the mall, and many more.

The card has several features and benefits that make it an ideal choice for shoppers looking for an easy and convenient way to pay for their purchases on Flipkart. Some of the card’s key features include cashback on all Flipkart spends, no-cost EMI on select items, fuel surcharge waiver, and more. The card also offers various other benefits such as dining, travel, and shopping discounts.

Benefits of Flipkart axis bank credit card

As we have already discussed, this Flipkart Axis bank credit card is one the best credit cards because it is used by lots of users who love to shop online as well as it offers lots of benefits to its users which make it the best choice in the Indian market. Some key benefits of using this card include cashback, discounts, fuel surcharge waiver, and complimentary airport lounge access. Let’s take a closer look at each of these benefits:

Cashback: Flipkart axis bank’s credit card offers up to 5% cashback on all your spending. This benefit or feature makes this credit card the best or great choice for its users as they will earn rewards while purchasing any product.

Discounts: In addition to cash back, this card offers exclusive discounts on Flipkart and Axis Bank products and services. This thing will help the users to save money on shopping and travel expenses.

Fuel surcharge waiver: Another great benefit of using this card is that it offers a fuel surcharge waiver. This means you can save up to 2.5% on fuel expenses when you use this card to pay for your fuel purchases.

Complimentary airport lounge access: Another perk of using this card is complimentary airport lounge access which allows you to relax and unwind in the comfort of an airport lounge before your flight.

These are just some of the many benefits you can enjoy when using a Flipkart Axis Bank credit card. So, in my opinion this credit card will be a great choice for guys because it offers lots of benefits and features which you may love.

Charges on Flipkart axis bank credit card

You will not be surprised to know that this flipkart axis credit card may charge you when you use this credit card. However, it will charge you less as compared to other bank credit cards. Here’s what you need to know about the charges on your card:

Annual fee: The annual fee for using your Flipkart Axis Bank credit card is Rs. 500 which is waived for the first year of use.

Transaction fees: When you make a purchase using your Flipkart Axis Bank credit card, you’ll be charged a transaction fee of 2.5% which is capped at Rs. 500 per month.

Cash advance fee: If you take a cash advance from your Flipkart Axis Bank credit card, you’ll be charged a cash advance fee of 3% (min. Rs. 500).

Late payment fee: If you make a late payment on your Flipkart Axis Bank credit card, you’ll be charged up to 2.5% of the outstanding amount (min. Rs. 500).

Over-limit fee: If you exceed your credit limit on your Flipkart Axis Bank credit card, you’ll be charged an over-limit fee of 2.5% of the over-limit amount (min. Rs. 500).

How to get a Flipkart axis bank credit card?

It’s not very difficult to get a Flipkart Axis Bank Credit Card as you can apply online for its official website. However, if you find difficulty while applying for this card, then you may follow the below steps.

● First of all, you have to visit the official website of Flipkart and log in to your account using your phone or email id.

● Then, you have to tap on the ‘Banking’ tab and from the drop down menu click the ‘Credit Cards’ option.

● Click on the ‘Apply Now‘ button next to the Flipkart Axis Bank Credit Card option.

● Fill out the application form with your personal and financial details.

● Lastly, you have to submit the form and wait for a while until any decision comes from the Axis Bank. If it gets approved, then you may receive a mail about the approval of your credit card within a few days.

How to activate the Flipkart axis bank credit card?

If you have a Flipkart Axis Bank Credit Card, you can activate it by following these simple steps:

● Visit the Flipkart Axis Bank Credit Card website and log in to your account using your user ID and password.

● 2. Click on the “Activate” link under the “Card Activation” heading.

● After this, you simply have to enter the 16-digit credit card number and the 6-digit activation code which is printed on the card statement.

● Finally, you have to tap on the “Submit” button to complete this activation process.

You will then be able to use your Flipkart Axis Bank Credit Card to make purchases on Flipkart and earn rewards points.

How to pay the Flipkart axis bank credit card bill?

It’s easier for you to repay your credit card online if you’re a Flipkart Axis Bank Credit Card holder. Here’s how:

● Log in to your account on the Flipkart website.

● Go to the ‘My Orders‘ section and select the ‘Pay Now‘ option for the relevant order.

● Enter your Axis Bank Credit Card details and make the payment.

Moreover, it comes with automatic payments features which makes the repayment process easier and automatic as the payment will be automatically paid every month according to your Flipkart Axis Bank Credit Card bill.

How to increase the Flipkart axis bank credit card limit?

If you are a customer of Flipkart Axis Bank Credit Card, then you can easily increase your credit limit by following the steps mentioned below:

● First of all, you have to go to the official website of Flipkart Axis Bank Credit Card and log in to your flipkart account using your phone number or email id.

● Click on the ‘Request Credit Limit Increase‘ option under the Account Service’s tab.

● Enter the desired credit limit amount and click on the ‘Submit‘ button.

● Now, your request will be processed and if it gets approved you may get a confirmation message.

● Lastly, after approval, you may see that the new credit limit may be reflected in your account.

How to track a Flipkart axis bank credit card?

It’s very easy for you guys to track your Flipkart axis bank credit card. Furthermore, you can track the card in two ways, the first one is through your account and the second one simply calls customer service. As to track online, you first of all, login in your account using your user ID and password. Then, simply tap on the “Account” tab and from the drop down menu click the select “Credit Cards” option. You will see your credit card activity here, including any recent changes or payments.

How to close the Flipkart axis bank credit card?

To close your Flipkart Axis Bank Credit Card, you will need to visit the Axis Bank website and follow the steps below:

● First of all, you have to go to official website and login on your account by entering your username and password.

● Then, simply tap on the ‘Credit Cards‘ option under the drop down menu.

● After this, you simply have to choose the credit card from the list which you have to close.

● Click on the ‘Close Credit Card’ button.

● Now, you have to write the reason why you are closing this credit card and finally, tap on the ‘Submit’ button.

Moreover, you contact the customer care for closure of your credit card or they may call you. The customer care number for Axis Bank is 1-860-500-5555.

Also Check

HSBC Credit Card : How to HSBC Credit Card Apply, Benefits & Eligiblity

Can You Manually Enter Credit Card Information At Gas Station

How to Pay RBL Credit Card Payment: Benefits & Eligiblity

What Is The Benefits Kotak League Platinum Credit Card : (Full Reviews)

Apply for IndusInd Bank Credit Card – Check Eligibility & Apply Now

Frequently Asked Question (FAQs).

Can I use a Flipkart axis bank credit card anywhere?

Yes, you can use your Flipkart Axis Bank Credit Card anywhere that accepts Mastercard payments. This includes both online and offline merchants. So your card will be accepted whether you’re shopping for groceries or booking a hotel room.

Is Flipkart axis credit card free?

No, the Flipkart Axis credit card is not free as there is an annual fee of Rs. 500. After that, you will be charged a late payment fee of 2% of the outstanding amount if you pay your bill late. Overall, this card can be quite expensive if you don’t take advantage of the rewards program or discounts.

Is the credit card on the Flipkart axis good?

There is no short answer to whether the Flipkart Axis Credit Card is good as it totally depends upon youx if you love this card or not. But in my opinion it will be the best choice for the users as it comes with many exciting features which you do not get in any other credit card available on the market.

My name is Card-Topedia, and I’m the author of Cardtopedia.com, a blog about credit cards and banking. I’ve been passionate about fintech since graduating from university with an honours degree in finance. I currently live in London but have experience living and working abroad in several countries including Germany and Australia. With my financial background and personal experience, I’m passionate about helping people make informed decisions when it comes to credit cards and banking products. Through Cardtopedia, I provide unbiased reviews, tips and advice on how to maximize rewards while minimizing fees. My goal is to help readers simplify their finances so they can focus on what matters most – achieving financial freedom!