Are you looking for an easy and efficient way to transfer money from Chime to Apple Pay? If so, look no further! This blog post will provide step-by-step instructions on quickly and conveniently moving funds between the two payment solutions. With this guide, you can learn How To Transfer Money From Chime To Apple Pay in just a few simple steps.

How To Transfer Money From Chime To Apple Pay?

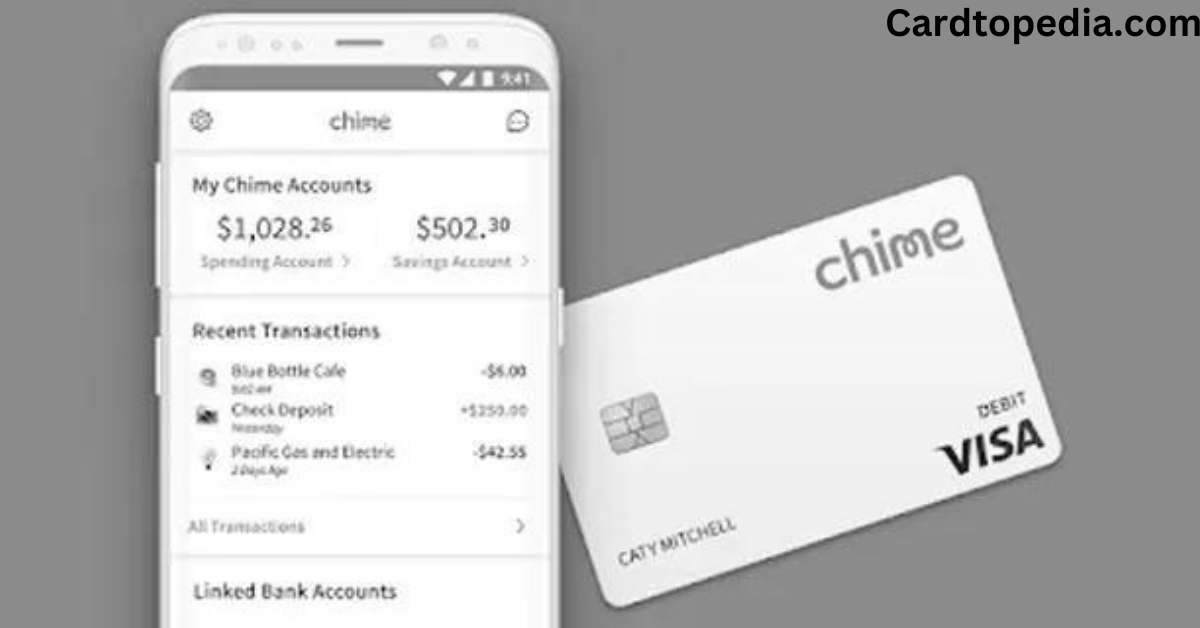

Chime, a digital banking platform, allows you to easily transfer money from your Chime account to Apple Pay. This makes it easy and convenient to send money to friends and family or pay for purchases using Apple Pay. To get started with transferring funds from Chime to Apple Pay, follow these steps:

- Log in to the Chime mobile app and tap on “Transfers” from the main menu.

- Select “Transfer Funds” under the “From” section and select “Apple Pay” as your method of payment.

- Enter the recipient’s name, email address, or phone number in the required fields and enter the amount you want to transfer.

- Tap on the “Transfer Now” button, and your funds will be transferred to Apple Pay.

Once the transfer is complete, you’ll receive a confirmation email or text message with further details about the transaction. You can then use your Apple Pay balance to make payments with any participating merchants.

Chime makes it easy to send money quickly, securely, and conveniently through its digital banking platform. With the ability to transfer funds from Chime directly into Apple Pay, you can enjoy peace of mind knowing that your money is safe and secure. With this guide, you can learn How To Transfer Money From Chime To Apple Pay in just a few simple steps.

What are the benefits of transferring money from Chime to Apple Pay?

- Instant and secure transfer of funds: Transferring money from Chime to Apple Pay is fast, secure, and convenient. The transaction is completed within minutes, ensuring you can access your funds quickly.

- Easily manage expenses: With the Chime-Apple Pay integration, customers can easily track their spending and receive real-time notifications whenever a payment is made or received. This allows them to stay on top of their finances and make informed decisions about how they use their money.

- Cost savings: By eliminating extra fees associated with traditional bank transfers, customers save time and money when sending payments between the two platforms.

- Increased convenience: Customers can send money directly from their Chime account to their Apple Pay wallet, eliminating the need to manually transfer funds between accounts. This makes it easier for customers to manage their finances and make payments quickly and securely.

- Peace of mind: By leveraging secure encryption technology, customers can rest assured that their financial information is safe and protected when transferring money from Chime to Apple Pay. Moreover, comprehensive fraud protection measures protect users from identity theft and other malicious activity. With this guide, you can learn How To Transfer Money From Chime To Apple Pay in just a few simple steps.

- Seamless integration: With the Chime-Apple Pay integration, customers can easily and quickly send payments from their Chime account to their Apple Pay wallet with a few clicks of a button. This makes transferring money between the two platforms hassle-free and simple.

How to use your transferred money in Apple Pay?

Once your money has been transferred to Apple Pay, you can use it for various purposes.

To make payments or purchase items using Apple Pay:

- Open the Wallet app on your iPhone, iPad, or Apple Watch.

- Select the card associated with your Apple Pay account.

- Look for the contactless payment symbol at the register and hold your device near it (or ask the cashier to scan it).

- Securely authenticate with Face ID, Touch ID, or passcode when prompted by your device.

- Once approved, you will receive confirmation that your payment was successful and hear a beep or vibration from your device. With this guide, you can learn How To Transfer Money From Chime To Apple Pay in just a few simple steps.

You can also use your Apple Pay balance to send money to friends or family.

- Open the Messages app and select a conversation with the person you wish to send money.

- Tap the App Store icon, then tap ‘Apple Pay‘ from the list of apps that appear.

- Choose an amount and enter your Apple Pay security code when prompted.

- Once approved, the money will be sent directly to their account, and funds will be available instantly for them to use in any way they wish – all without sharing financial details!

Finally, you can easily transfer money from Apple Pay to your bank account if needed, either through the Wallet app or your bank’s website. With this guide, you can learn How To Transfer Money From Chime To Apple Pay in just a few simple steps.

- Open the Wallet app and select the card associated with Apple Pay.

- Tap ‘Transfer to Bank‘ and enter the amount you want to transfer.

- Enter your security code when prompted and confirm the transfer details with Apple Pay.

- The money will be transferred back into your nominated account within 1-3 business days, depending on your bank’s processing times.

Following these simple steps, you can use your Apple Pay balance – for everyday purchases, send money to friends or family, or transfer funds back into your bank account!

Tips for using your transferred money in Apple Pay

Apple Pay is a great way to quickly and easily transfer money from one location to another. However, it’s important to know the best practices for using your transferred funds to maximize its potential. Here are some tips to help you get started:

- Keep track of transactions: Apple Pay makes it easy to keep an eye on your purchases and transfers, so be sure to monitor your account activity regularly. This can help identify unauthorized charges and alert you if there are unusual activities.

- Create budgets: Set up budgets for yourself or different categories that you use Apple Pay for to ensure that you don’t overspend or spend too much money at once. You can also use Apple Pay to pay bills quickly and easily.

- Use security features: Apple Pay is designed with industry-leading security features, so take advantage of them by enabling Touch ID or Face ID authentication for all payments and transfers. This can help ensure that your money stays safe and secure.

- Set up notifications: You can set up push notifications on your device to be alerted when a payment goes through or if there’s unexpected activity on your account. This will help you stay on top of all of your transactions.

- Utilize rewards programs: Some retailers offer rewards where you can earn points for every purchase made with Apple Pay, which you can then redeem for discounts or other rewards. Check with your favorite stores to see if they have any special offers for Apple Pay users.

By following these tips, you can get the most out of using Apple Pay and make sure that your money is handled safely and responsibly. With this guide, you can learn How To Transfer Money From Chime To Apple Pay in just a few simple steps.

Frequently Asked Question

Q: How long does it take to transfer money from Chime to Apple Pay?

Transferring money from Chime to Apple Pay should typically take 1-2 business days for the funds to appear in your Apple Pay Cash account. The exact time frame may vary depending on how quickly your bank processes the transaction. Please contact your financial institution directly if you would like an exact time frame.

Q: Is there a fee to transfer money from Chime to Apple Pay?

No, transferring money from Chime to Apple Pay is free. There are no fees associated with this type of transaction. However, if you use a third-party service such as PayPal or Venmo, they may charge a fee. Please check the terms and conditions of each provider before initiating the transfer.

Q: Are there any limits on how much money I can transfer from Chime to Apple Pay?

Yes, to protect customers and financial institutions, there are limits imposed on how much money you can transfer from Chime to Apple Pay. The exact limit will vary depending on your account type and other factors, so please contact your financial institution directly if you want to know more about these limitations. However, most transfers are generally limited to $2,500 per transaction.

Q: Can I use my Chime debit card to initiate a transfer from Chime to Apple Pay?

Yes, you can use your Chime debit card to initiate a transfer from Chime to Apple Pay. You just need to enter your debit card information when prompted during the transfer process and provide additional required verification details, such as an ID or security code. Please note that some banks may require additional authentication before allowing you to complete the transaction.

My name is Card-Topedia, and I’m the author of Cardtopedia.com, a blog about credit cards and banking. I’ve been passionate about fintech since graduating from university with an honours degree in finance. I currently live in London but have experience living and working abroad in several countries including Germany and Australia. With my financial background and personal experience, I’m passionate about helping people make informed decisions when it comes to credit cards and banking products. Through Cardtopedia, I provide unbiased reviews, tips and advice on how to maximize rewards while minimizing fees. My goal is to help readers simplify their finances so they can focus on what matters most – achieving financial freedom!

[…] How To Transfer Money From Chime To Apple Pay? […]

[…] How To Transfer Money From Chime To Apple Pay? […]

[…] How To Transfer Money From Chime To Apple Pay? […]